Whilst central Bangkok witnessed record prices in the final three months of last year, one real estate agency continued to express concerns about the midtown and suburban property markets.

In its latest MarketView Report focusing on the Bangkok Residential market in the final quarter of last year, CBRE Thailand noted that despite the government stimulus package that was launched in October 2015, the Bangkok condominium market as a whole continued to face a slowdown in Q4 2015 due to low confidence among buyers in the overall economy.

There was a drop in sales, resales and launches in all areas, the firm said.

The number of newly launched downtown condominium units in Q4 2015 decreased 48 percent year-on-year while the number of newly launched midtown/suburban condominium units shrunk 32 percent YoY.

Some developers have postponed their new project launches to 2016 due to the weak economic sentiment. This reflected the developers’ continued focus on transferring completed units and clearing built-but-unsold inventory throughout H2 2015, instead of launching new condominium projects.

With more than 53,000 units completed in 2015 and some 61,000 units or more expected to be completed in 2016 in the midtown and suburban areas, CBRE said the key factor continued to be how many end-users will be willing to transfer title on completion of a development and able to get a mortgage.

Although the Government Housing Bank agreed to provide THB 10 billion of housing loans to low-to middle income earners who could not get a residential loan, this amount of money is still very low compared to the total value of condominium units completed during the whole year, the firm reported.

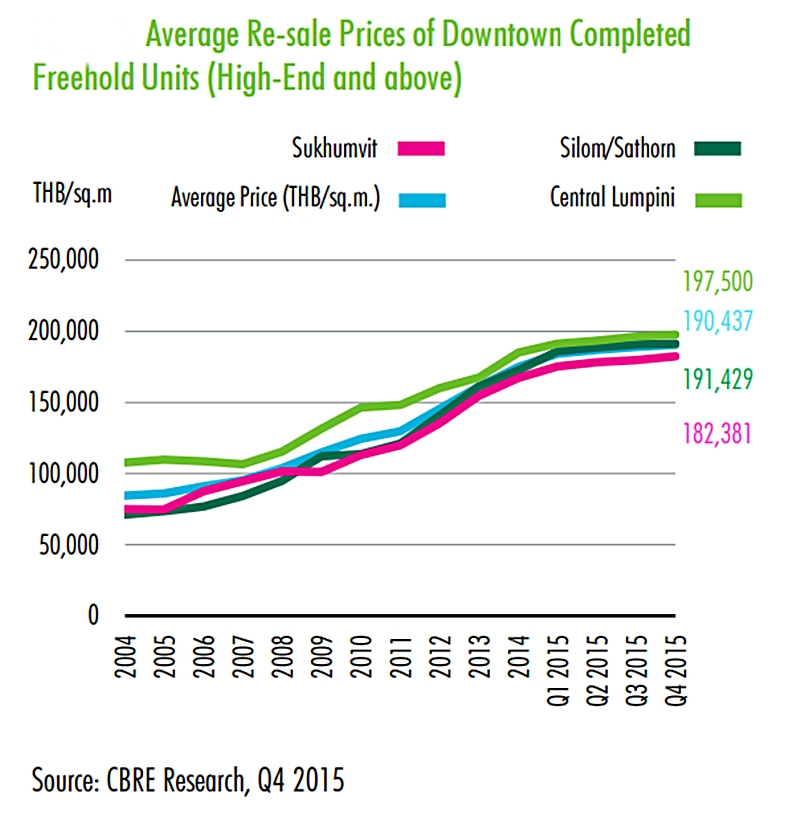

Overall, 2015 has been an interesting year for condominium market. New record prices of more than THB 300,000 per sqm were achieved in both completed and under-construction buildings in the prime downtown areas despite the economic slowdown.

Going forward into the rest 2016, CBRE said that it expects a slow year for the condominium market. Nevertheless, there are a number of downtown condominium projects in the pipeline including some projects that have been postponed from 2015. The rate of new launches will be stable or slightly higher in the downtown area but will be lower in some midtown and suburban areas where there is a large amount of unsold future condominium supply waiting to be absorbed.

During this period of weak demand, projects in less prime or non-prime downtown locations and midtown/suburban areas will likely face stronger competition.

CBRE said that it anticipates that prices for newly-launched condominiums located in the best downtown locations will continue to rise because land prices are constantly increasing. It will be very hard to develop a new project in the prime downtown area at an asking price of below THB 200,000 per sqm.

The risk, CBRE said, is that not every project will capture buyers’ imagination and there is only a small pool of potential buyers who can afford these luxury products.

With the prices of newly launched condominiums being almost five times higher than some 20-year-old condominium projects, CBRE expects this to have an upward pressure on the resale prices of existing condominium projects – but this will only limit to well-designed projects in the best downtown locations that have been well maintained.